Bukit Asam (PTBA) Actively Pursues Coal Downstreaming Projects

Fri 12 Sep 2025, 12:53 PM

Share

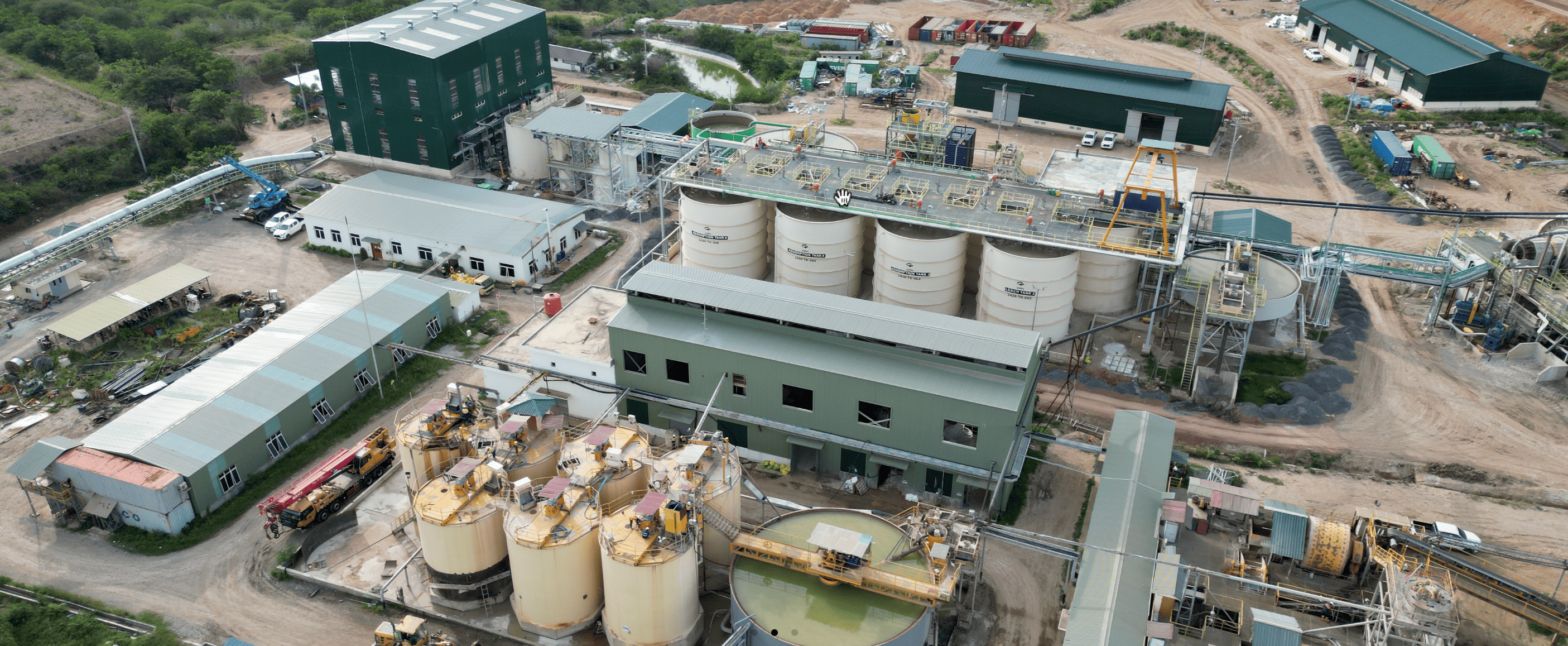

PT Bukit Asam Tbk (PTBA) is actively diversifying its business by working on several downstream projects derived from coal products.

The Director of Downstream and Diversification Products, Turino Yulianto, stated that PTBA recently started a project to develop Potassium Humate by utilizing low-calorie coal products.

For this project, PTBA is partnering with Gadjah Mada University (UGM) for research purposes.

Since it is still in the pilot plant phase, PTBA's current potassium humate production is only around 150 tons per year.

However, if further developed, there is potential to increase its production capacity to 235,000 tons per year.

Turino admitted that the potassium humate product has already garnered significant interest from agricultural and plantation businesses, such as PTPN and PT Agrinas.

He stated during a public expose on Thursday (September 11) that they could fully commercialize this product within the next few months.

In addition, PTBA is also developing the downstream processing of coal into Artificial Graphite.

This is a coal derivative product that can support the electric vehicle battery ecosystem. PTBA is collaborating with the National Research and Innovation Agency (BRIN) on this project.

PTBA has the capability to produce 200 tons of Artificial Graphite per month. However, for the current pilot plant scale, PTBA's Artificial Graphite production is set at 41 tons per month.

Furthermore, since last year, PTBA has been working on a Wood Pellet development project from the Kaliandra Merah plant, located in the company's post-mining area in Tanjung Enim, South Sumatra.

UPN Veteran Yogyakarta is also a partner for PTBA in this project.

For the initial phase, PTBA is producing 96 tons of Wood Pellets per month.

This product is used as an alternative biomass source to support carbon emission reduction, especially in mining areas.

When contacted separately, Korea Investment & Sekuritas Indonesia Analyst Muhammad Wafi said that coal downstreaming is an important strategy for PTBA to anticipate the trend of declining commodity prices.

"These projects have the potential to be long-term catalysts for PTBA, as they can reduce dependence on raw coal prices," he said on Thursday (September 11).

Nevertheless, this expansion also presents challenges in terms of funding and execution of the downstream projects themselves. The downstream projects are expected not to become a burden on PTBA's cash flow.

Therefore, PTBA must pay attention to factors such as strategic partners, project economics, and the speed of the project's progress. If managed well, downstreaming will be a turning point for PTBA's performance.

Wafi also recommended a "trading buy" for PTBA shares with a target price of IDR 2,800 per share.