Abadi Nusantara (PACK) Acquires Two Mining Companies in North Konawe

Wed 01 Oct 2025, 14:45 PM

Share

PT Abadi Nusantara Hijau Investama Tbk. (PACK), through two of its subsidiaries, announced share acquisition transactions in two mineral mining companies in North Konawe, Southeast Sulawesi.

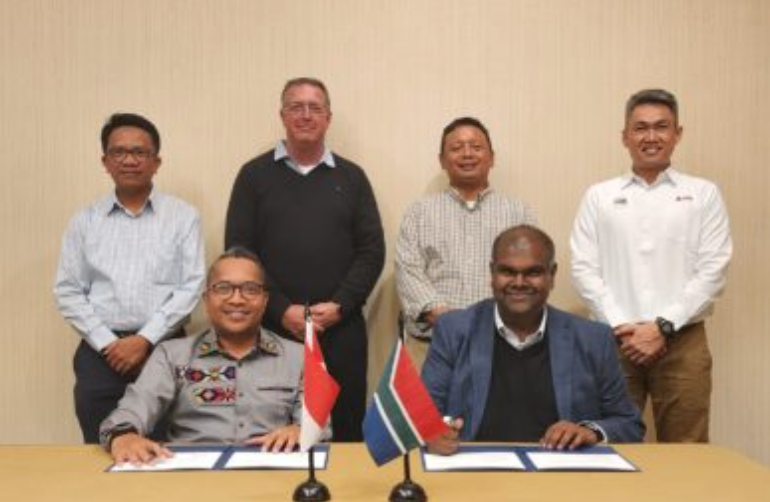

According to the disclosure, PACK’s subsidiaries—PT Adhi Prakarsa Raya (APR) and PT Sumber Cahaya Raya (SCR), each 99.998% owned by the company—signed Share Sale and Purchase Agreements (SSPAs) with Denway Development Limited on September 26, 2025.

The transactions cover the transfer of 240 shares of PT Konutara Sejati (KS) to SCR and 276 shares of PT Karyatama Konawe Utara (KKU) to APR. The transfers became effective upon issuance of the Acknowledgment Letter of Notification of Corporate Data Changes by the Ministry of Law and Human Rights on September 29, 2025.

PACK President Director Magdalena Veronika explained that full payment for the acquisitions will be completed no later than January 31, 2026, or as otherwise mutually agreed by the parties.

“Full payment obligations for the share transfers above shall be fulfilled no later than January 31, 2026, or at another time agreed by SCR, APR, and Denway Development Limited,” Magdalena said in the disclosure on Tuesday (September 30, 2025).

Magdalena emphasized that these transactions do not have a material impact on the company’s operations, legal standing, or financial condition. In addition, the transactions do not constitute affiliated transactions or conflicts of interest, but are categorized as material transactions under OJK regulations.

Previously, PACK announced a plan for strategic corporate actions to be submitted for approval at an Extraordinary General Meeting of Shareholders (EGMS) on September 25, 2025.

On the agenda, the company proposed a change in business activities from printing manufacturing to a holding company. Operational focus would be directed to subsidiaries, particularly in mineral trading.

In parallel, the company also plans to issue Mandatory Convertible Bonds (MCB) into new shares via a Rights Issue (PMHMETD). The MCBs are prepared to convert into up to 35 billion new shares, with the rights issue proceeds to finance minority acquisitions in PT Konutara Sejati and PT Karyatama Konawe Utara through PT Sumber Cahaya Raya and PT Adhi Prakarsa Raya.

The acquisition value amounts to USD 68.7 million for a 30% stake in PT Konutara Sejati and USD 100.08 million for a 34.5% stake in PT Karyatama Konawe Utara. An independent valuation report states that the transactions are material because their value is more than 4,384.94% of the company’s equity as of June 2025.

Even so, management stressed that the transactions are conducted at fair value and do not constitute affiliated transactions. The company also emphasized that the Rights Issue will strengthen its capital structure, reduce the debt-to-equity ratio, and increase operational capacity.

However, shareholders who do not exercise their rights may be diluted by up to approximately 95.58%. In this case, PT Eco Energi Perkasa, as the controlling shareholder, will act as a standby buyer for any unsubscribed shares from public shareholders.